What is the SaHo Model about?

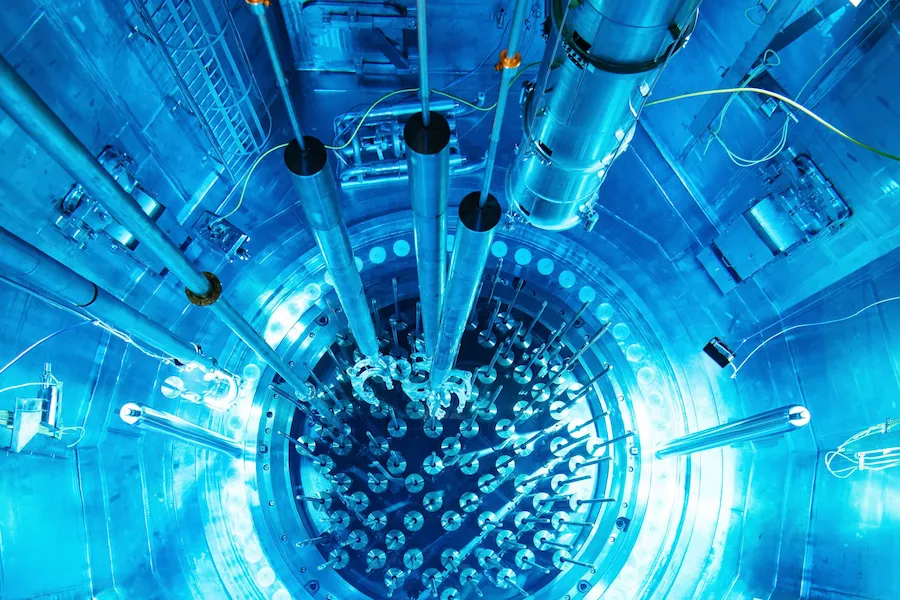

The SaHo Model is an innovative business/financial model designed for the nuclear power, but also applicable to other large infrastructure projects. It is the result of several years of detailed analysis of models used in and proposed for the nuclear power sector as well as a result of dialogue with Polish energy consumers, in particular the energy-intensive industry. The most important objective of the SaHo Model is to provide the cheapest possible energy to end-users, i.e. businesses, public institutions (state and local government) and households.

The Model is based on the 50-year experience with cooperative models used in the nuclear industry in Finland, Switzerland and the United States. It also takes advantage of proven solutions from other countries (public power: Germany, the Netherlands, Switzerland) and Poland (i.a. industrial power / autoproducers).

What is the SaHo Model about? The state or its equivalent* (the so-called initial investor) establishes a stock company to build and operate a nuclear power plant (NPP). Then it sells shares of the company to energy consumers (so-called final investors), at any time during the construction period. Sales of shares are carried out on a market basis, in tranches intended for specific types of energy consumers. From the start of energy generation shareholders have the right and obligation to offtake it at the cost of production, in proportion to their share in ownership. The power plant is not profit-driven. It is a state-initiated (and possibly state-controlled) quasi-cooperative of energy consumers. The sale of shares of the power plant (power unit) may take place at any time during the investment process, but before the grid connection.

The SaHo Model can be implemented for a nuclear project by a state investor or a private one, as long as they meet the criteria described below. In both variants, there is a possibility to maintain / take state control of the NPP using legal tools. In the case of Poland, there are at least several such instruments, but similar solutions also exist in other countries.

* state equivalent in the SaHo Model is a non-state entity meeting the following conditions: (a) it is able to assume the risk of the construction period, (b) it guarantees the completion of the project, (c) it has access to low-cost capital, and (d) its purpose is to sell shares to final investors before the NPP is commissioned. In addition, if the entity is not controlled by the host government, it can be considered as 'private’ (even if it is controlled by the government of another country).

The SaHo Model was developed in Poland. Its name comes from the surnames of the Authors: Dr. Bożena Horbaczewska, a financier and researcher at the SGH Warsaw School of Economics, and Łukasz Sawicki, a nuclear industry analyst. The Model was described and published in the International Journal of Management and Economics (also available on Researchgate).

Key advantages of the Model

-

Low costs of energy production in NPP

A NPP generates cheap energy by financing its construction with the lowest possible cost of capital.

-

The cheapest energy for consumers

Owners-consumers offtake energy from their own NPP at the cost of its generation, without profit margins, and without costs of intermediaries.

-

Nuclear power for everyone

Anyone can become a co-owner of a nuclear power plant, be it a company, a household or even a local government.

-

Voluntariness

The purchase and sale of shares of a NPP are voluntary, no one is forced to finance a nuclear project in the form of quasi-taxes, nuclear levies, etc.

-

Business flexibility

Investors can buy and sell NPP shares at any time, according to their own energy needs (under state supervision - to the extent necessary).

-

Revenue guarantee for NPP

The NPP has guaranteed revenues covering its full costs of production - there is no price or volume risk, so there is no need to construct special CfD-like mechanisms.

-

Compliance with EU regulations

Similar models are used in the EU and have an acceptace of the European Commission, and are also promoted in EU's long-term energy development strategies.

-

Suitable for all

The SaHo Model can be applied in most (if not all) countries of the world, as it is based on cooperative principles, but also on the general principles of companies.

-

Reuse of Funds mechanism

The funds raised by the initial investor from the sale of shares of the first reactor can be used to finance the construction of a subsequent reactor - reducing the cost of delivering a large nuclear programme to as much as the value of one reactor.

Versions of the SaHo Model

The SaHo Model is flexible, which, among other things, gives it the ability to be adapted to the different requirements of nuclear projects. Below there are selected versions of the Model that we have prepared to demonstrate its capabilities.

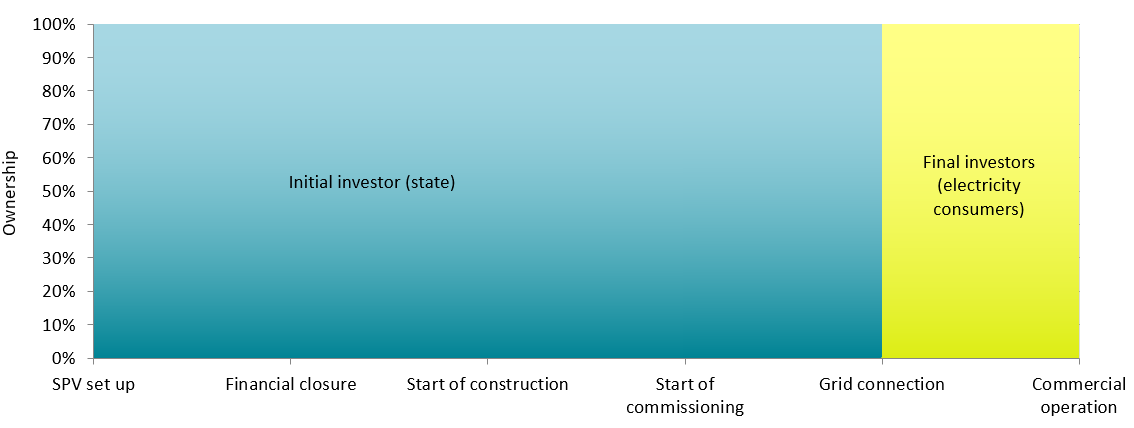

The simplest version of the SaHo Model showing its main assumptions. During the project pre-development, development and subsequent construction phase, the nuclear unit is wholly owned by the state. Once connected to the grid, all shares of the unit are sold to end-users. In practice, this version can be applied to First-Of-A-Kind (FOAK) projects. This may be the first implementation of the SaHo Model in a given country, or the first project in a given technology, when the concerns of potential final investors about the project completion discourage them from buying shares before the construction is completed. In the case of Poland, given the current energy situation, this option would rather apply to SMR technologies, which are FOAK technologies.

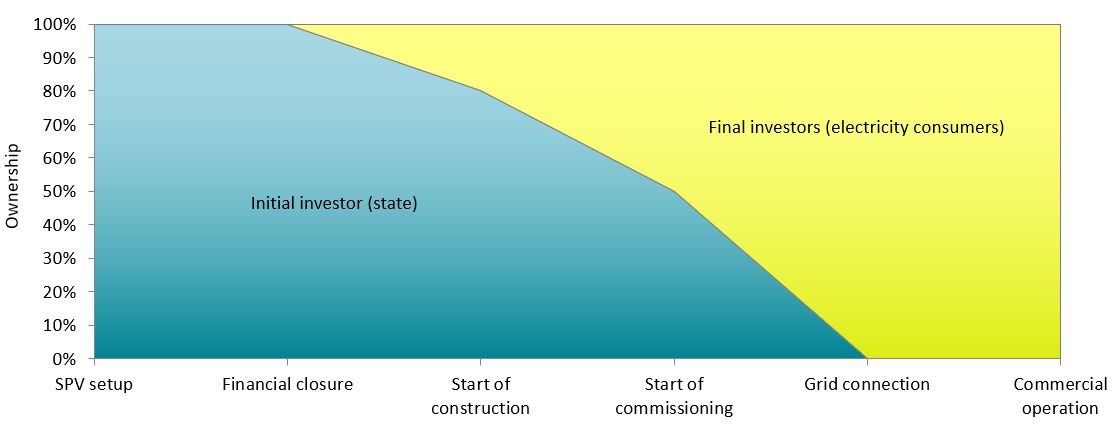

In this version of the SaHo Model the sale of shares begins just after the financial closure and before any significant physical work on site begins. Sale of shares takes place gradually over the entire duration of construction, roughly in proportion to the decline in investment risk, with the last shares going to final investors just before the reactor is connected to the grid.

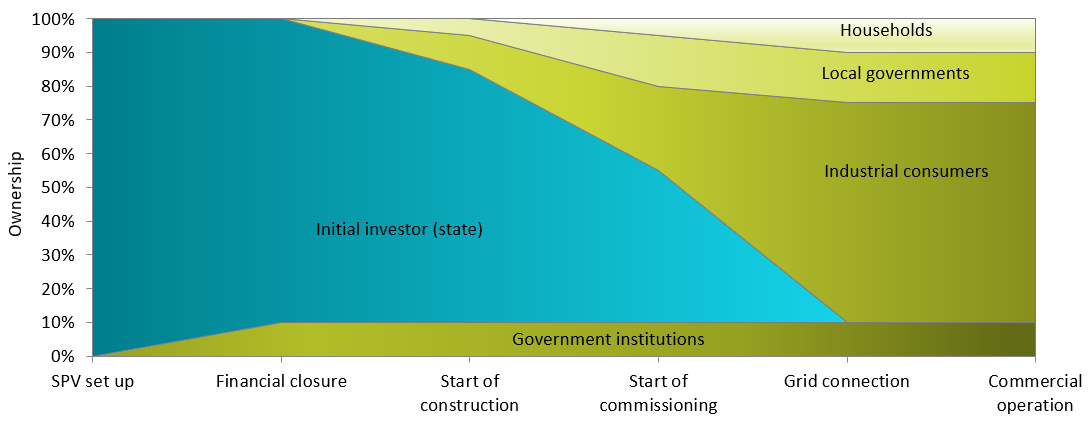

An expanded, more detailed version of the Model with a gradual sale of shares to final investors. This version presents an illustrative ownership structure by selected types of final investors, i.e. government institutions, industry, local governments and households (indirectly through aggregators, e.g. energy cooperatives). The ownership structure is just illustrative but, in the Authors’ opinion, appears to be the most realistic, i.e. the dominant group would probably be industrial consumers or companies from various sectors, not only industry (e.g. transport, logistics, trade).

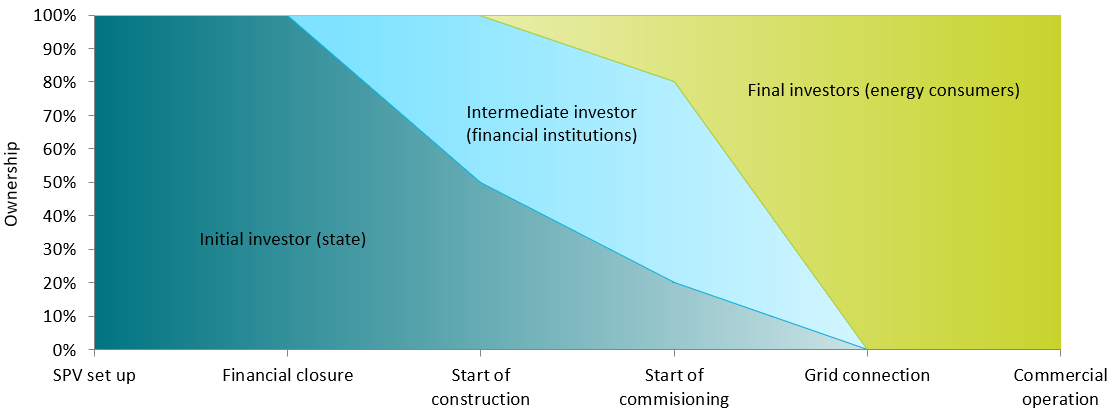

This version emphasises the role of financial institutions. They can play the role of intermediate investor, which buys part of the shares from the primary investor during construction, then takes part of the risk of the investment and subsequently sells the shares to final investors. Such an option can increase the credibility of the project and motivate timely completion of the investment. The sale price of the shares to the final investors will certainly be higher than their purchase price (due to the reduced investment risk), allowing the financial institution to get a correspondingly high rate of return.

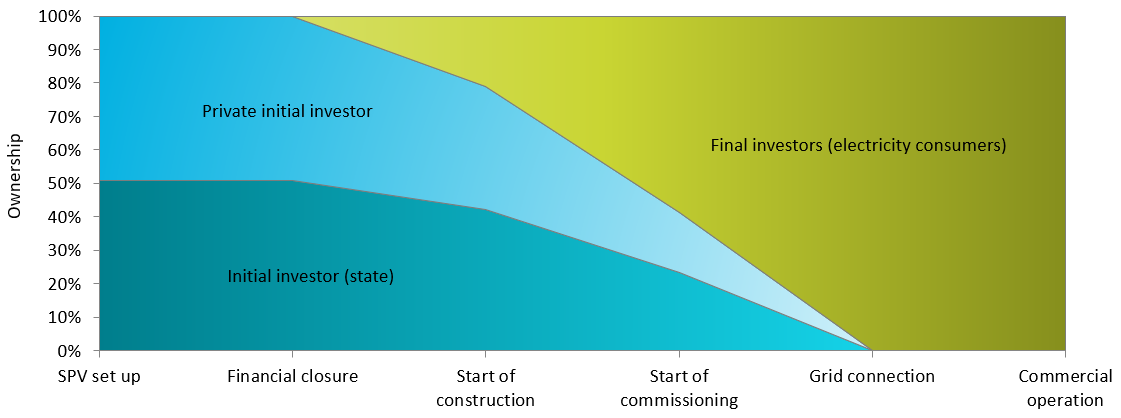

This version of the Model was prepared for projects where part of the shares are held by a reactor vendor cooperating with associated energy company and financial institution, who are considered a private primary investor. This group of entities acts as a second primary investor which, like the state primary investor, seeks to sell shares in the nuclear unit to final investors before connecting it to the electricity system.

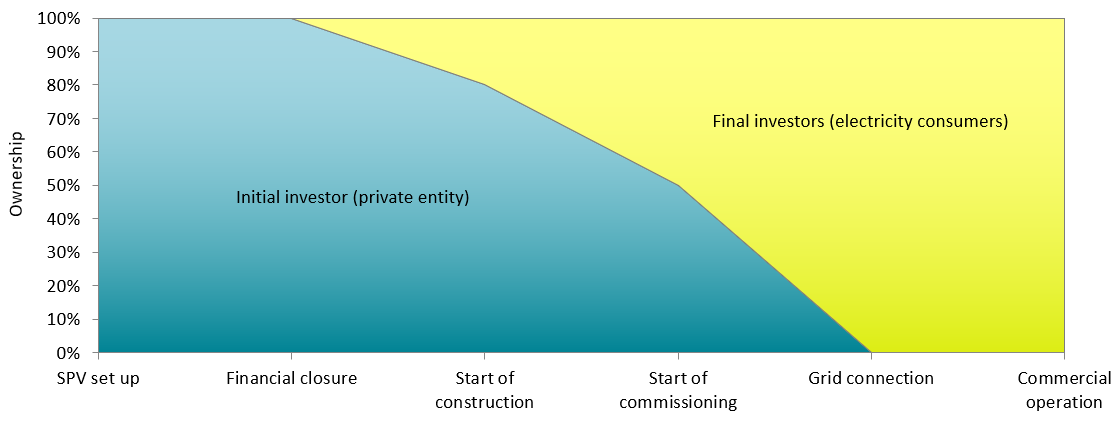

A version of the Model similar to the basic concept (B), except that instead of the state the project is carried out exclusively by a private entity (or group of entities). Such an entity must meet the following conditions: (a) it is not controlled by the government of the host country, (b) it is able to take the risk of the construction period, (c) it guarantees the completion of the project, (d) it has access to low-cost capital, (e) its goal is to sell shares to final investors before the NPP is operational.

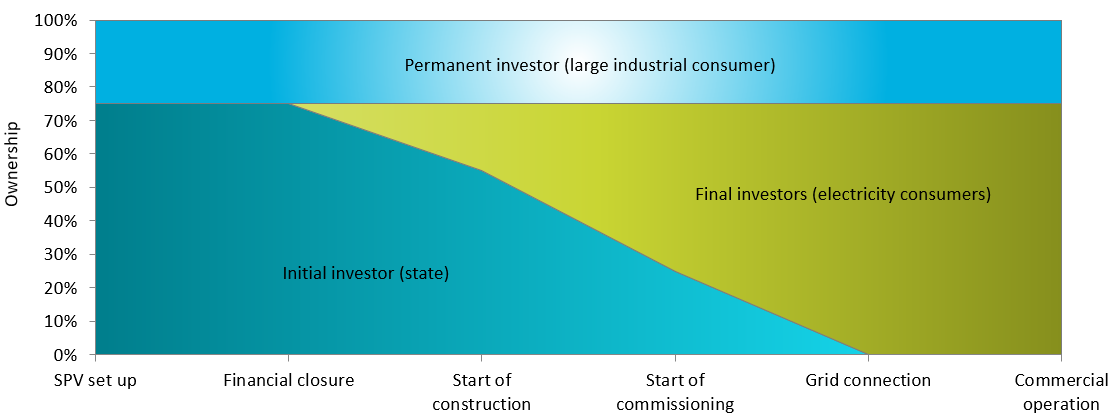

In this version of the Model there is a second investor (called the permanent investor) in addition to the primary investor (state or private). This investor owns a certain number of shares in the nuclear unit from the beginning of the project and maintains this ownership also during the operation phase. Such an investor can be, for example, a large industrial consumer.

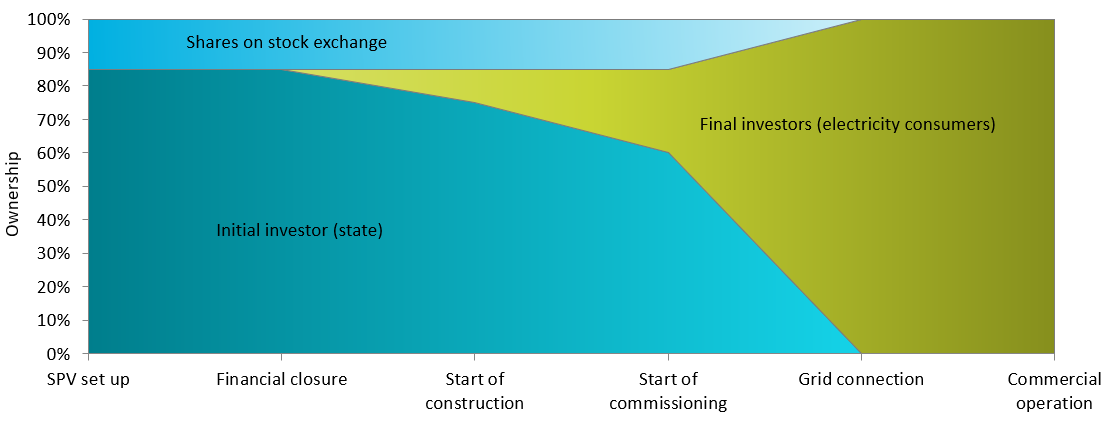

In this version of the Model some portion of the shares is listed on a stock exchange. A certain number of the company’s shares may be offered to investors already at the time of the share issue or later when the initial investor decides to do so. The shares can only be listed on the stock exchange until the power unit is connected to the grid. From this moment the shares can be retained by investors giving them rights to offtake energy in proportion to ownership. They can also be contributed to an aggregator such as an energy cooperative or sold to other final investors.

The advantage of this solution is the possibility to voluntarily invest in NPP shares, which allows a large number of investors to be involved, mobilises additional capital and gives a market valuation for NPP shares.

Various combinations of the above versions of the SaHo Model are also possible.

Other versions are also being developed, including those dedicated to specific investment projects carried out in Poland. They may be adapted to the assumptions and requirements of specific investors and supplemented with additional mechanisms built specifically for the needs of a given project.

The cheapest energy from nuclear power

In order to provide the electricity consumer (e.g. household, business, local authority) with the cheapest possible electricity (possibly also district heat), at least two criteria must be met:

- Low cost of energy production at the power station;

- Share in power plant ownership by the energy end-user.

Nuclear power plants (NPPs) can be sources of the cheapest energy produced continuously and weather-independently, whenever it is needed. For this to happen, the following conditions must be met:

- financing of the construction process with cheap capital;

- implementation of the investment by an entity able to bear the project risk;

- operating the NPP continuously close to installed capacity, and selling all the energy produced.

The SaHo Model meets the first two conditions thanks to so-called primary investor, which is a large entity such as the state (e.g. a state-owned energy company or an investment fund) or its equivalent (e.g. an experienced vendor cooperating with financial institutions). The third condition is implemented through the sale of shares to end-users, who have the right and obligation to offtake the energy produced proportionaly to share in ownership.

Ownership of NPPs by end-users means that they do not bear the costs of intermediaries, i.e. so-called trading companies (energy traders). This has been successfully applied in nuclear power in Switzerland, the United States and Finland for about 50 years and new nuclear units are being built based on it.

Nuclear power for everyone

Any type of energy end-user can be the co-owner of an NPP in the SaHo Model. It may be a company of any size, a household or even a local government as well as governmental institutions, e.g. offices or the military.

In case of the smallest consumers (households, small businesses), a kind of aggregator would be needed, for example an energy cooperative. This is because of their small power demand and specific daily load profile, which is not compatible with the requirements of NPP operation. Such solutions have been successfully used for more than 50 years in Switzerland, the United States and Finland.

In addition, only during the construction phase, a financial investor (including an individual) may become a shareholder whose aim is to make a profit on sale of its shares.

What about energy trading companies? In principle, the Model is intended for end-users, but energy trading companies are acceptable as minority shareholders in specific cases.

Voluntariness

The SaHo Model is based on the principle of voluntariness. No company, household or local government is forced to buy shares in the NPP, or to finance its construction, as is the case with utility power models (more about models).

Of course, in case of implementation of the investment by a state entity and/or using taxpayers’ money (so-called public money) one may ask whether this is not a form of compulsion? Even if we assumed so, it should be taken into account that the state is carrying out the public task, i.e. using taxpayers’ money to realise a public purpose investment in an efficient manner and to their maximum benefit. It must also be emphasised that the state sells shares in the NPP to the final investors recovering in this way the public money invested. Shares can be bought by any taxpayer giving him the right to offtake the energy at the lowest possible cost. It can’t be achieved in any other method. There are no transaction costs, i.e. the costs of intermediaries (like energy trading companies).

Business flexibility

The business flexibility of the SaHo Model derives from two of its features. The first one is the relatively free trading of NPP shares with the necessary state oversight (e.g. the mandate to deny the sale of shares to an entity posing a national security risk). During the construction phase any natural or legal person can be a shareholder. At the operation stage, only the end-users can be the shareholders. This rule results from the obligation imposed on shareholders to offtake the energy, which is a key feature of the Model. Some exceptions to this rule are allowed, as long as they do not distort the Model’s essence beeing a quasi-cooperative of energy consumers.

The second feature is that the Model can be adapted to different investment projects without compromising its essence, examples of which are included above in the drop-down list.

Revenue guarantee for NPP

In the SaHo Model the NPP during the operation phase has guaranteed revenues from the sale of energy. These revenues are enough to cover all production costs thanks to the commitment of shareholders to pay fixed and variable costs of the NPP. This has been practised in similar models in the US and Finland since the 1970s. Therefore there is negligible risk of generating losses.

Reuse of Funds mechanism

The Reuse of Funds mechanism embedded in the SaHo Model works as follows: the primary investor uses the income received from the sale of shares of a nuclear unit to finance the construction of the subsequent one. In this way, it is possible to reduce the expenses needed to cover the costs of construction of a series of reactors to the scale of even a single reactor. In practice, the use of this mechanism depends on a number of factors, including the pace of share sales and the pace of construction of the next units, but in principle the mechanism does its job. As a result, the government doesn’t need to freeze tens of billions of dollars in the budget for several decades. In the extreme case, an amount of a few billion USD, the equivalent of one nuclear unit, would be sufficient.

The sale price of the shares will certainly be higher than the cost of their acquisition. So the excess funds raised from the sale of shares above the investment needs for the construction of the next nuclear unit can be returned to the state budget.

Reuse of Funds mechanism is a new concept created by the authors of the SaHo Model. It is not a refinancing of investments, it is a completely new financial mechanism that has not yet been used in the nuclear power sector.

Compliance with EU regulations

The SaHo Model is in principle in line with EU regulations and policies regarding the energy market. The Model is based on autoproduction and energy (quasi)cooperatives, which fits in with the energy sector policies to 2050 set out in various documents. Similar mechanisms are present in the Finnish Mankala model, which has the approval of the European Commission. An important advantage is that it operates in a specific way and does not need price regulation mechanisms. These mechanisms are conditionally allowed in the EU since 2024 and are treated by definition as state aid (so-called 'support mechanisms’).

Whether elements of (acceptable) state aid appear in the SaHo Model is determined by how it is implemented. There are many possibilities, some of which do not provide for elements that could be considered as state aid. Regardless of that, the Model has mechanisms to increase its 'marketability’, e.g. the sale of NPP shares by a state-owned primary investor through open, transparent and non-discriminatory auctions or tenders, and the subsequent trading in shares in bilateral contracts between final investors.

Benefits of the Model

The construction of a nuclear power plant in the SaHo Model offers many benefits to the various stakeholders involved in the project:

- government;

- investors;

- energy consumers;

- as well as the climate, which is a silent stakeholder in all zero-carbon energy projects.

For more information on various aspects of the SaHo Model, see our publications and interviews: